20 February 2025

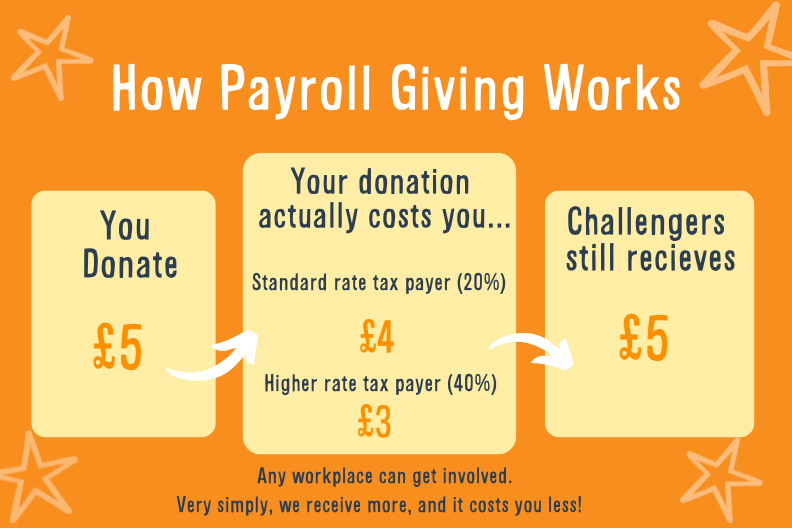

Did you know there’s a simple way for you to make a regular monthly donation straight from your salary? It’s called Payroll Giving, and it’s the most effective way of giving to charity as it comes out of your pay before tax!

To put it simply, we receive more money for Challengers at no extra cost to you.

If you’re a business owner Payroll Giving helps you to gain recognition from industry peers by achieving a Quality Mark Award – a government award given to businesses who execute varying levels of Payroll Giving across their organisation. A great thing to shout about!

Benefits of Payroll Giving for employers and businesses:

- Engages employees in Charity Partnerships, and as a business you support their charitable giving.

- There is no cost to the organisation to set it up.

- Boosts staff morale.

- Demonstrates community support.

Benefits of Payroll Giving to employees:

- It costs you less to donate more to charity.

- It is a quick and convenient way to give for those who don’t time to help in other ways.

- It comes directly off your pay slip so no bank details are required to set it up (and we will only contact you if you tell us you want to be kept up to date).

- You can donate to more than one charity.

- You can stop or change the amount at any time, and if you stop working for your employer for any reason this will be cancelled automatically.

- There is no limit on the size of the gift.

Payroll Giving is hugely beneficial to Challengers as it allows us to plan ahead, and maintain a regular and sustainable income. Every time you are paid you are directly supporting Challengers in providing fun and inclusive opportunities for disabled young people.

Payroll Giving is easy to set up and we can help with every step of this process. If you would be interested to learn more, or set up a Payroll Giving donation please do not hesitate to contact us at chrismcisaac@disability-challengers.org or call 01483 230060.